Will Hopper is a term used to describe a person who frequently changes their will, often making significant alterations to the distribution of their assets. This can be done for various reasons, such as changes in personal circumstances, relationships, or financial situations.

Will hopping can have several implications. It can create uncertainty and confusion among beneficiaries, potentially leading to disputes and legal challenges. Additionally, it can increase the costs associated with estate administration, as multiple wills may need to be probated. However, will hopping can also be beneficial in certain situations. For example, it allows individuals to adapt their estate plans to changing circumstances, ensuring that their wishes are met even in unforeseen events.

Historically, will hopping has been used by individuals to disinherit certain family members or to make provisions for individuals who were not initially included in the will. In some cases, will hopping has been used to avoid or minimize estate taxes. However, with the advent of modern estate planning techniques, such as trusts and joint ownership, will hopping is becoming less common.

Will Hopper

A will hopper is a person who frequently changes their will, often making significant alterations to the distribution of their assets. This can have several implications, both positive and negative.

- Legal implications: Will hopping can create uncertainty and confusion among beneficiaries, potentially leading to disputes and legal challenges.

- Financial implications: Will hopping can increase the costs associated with estate administration, as multiple wills may need to be probated.

- Personal implications: Will hopping can be a sign of indecisiveness or a lack of estate planning knowledge.

- Tax implications: Will hopping can be used to avoid or minimize estate taxes, although modern estate planning techniques are more effective for this purpose.

- Beneficiary implications: Will hopping can disinherit certain family members or make provisions for individuals who were not initially included in the will.

- Executor implications: Will hopping can make it difficult for executors to administer the estate according to the testator's wishes.

- Contestation implications: Will hopping can increase the likelihood of a will being contested, as beneficiaries may challenge the validity of a will that does not reflect the testator's final wishes.

- Planning implications: Will hopping can be avoided by working with an estate planning attorney to create a comprehensive and up-to-date estate plan.

Overall, will hopping is a complex issue with several potential implications. Individuals who are considering changing their will should seek professional advice to ensure that their wishes are met and that their estate is administered according to their intentions.

Legal implications

Will hopping can create legal implications because it can lead to uncertainty and confusion among beneficiaries. This can happen for several reasons. First, if a person makes multiple wills without properly revoking the previous ones, it can be difficult to determine which will is the most recent and valid. This can lead to disputes among beneficiaries as to which will should be followed. Second, if a person makes changes to their will without consulting with their beneficiaries, it can lead to confusion and resentment. Beneficiaries may feel that they have been unfairly treated or that their wishes have not been taken into account.

In some cases, will hopping can also lead to legal challenges. For example, if a beneficiary believes that a will was changed under duress or undue influence, they may challenge the will in court. Additionally, if a will is found to be invalid due to lack of capacity or improper execution, it may be set aside, which could lead to further legal disputes.

Overall, will hopping can have a number of negative legal implications. It is important for individuals to work with an estate planning attorney to create a comprehensive and up-to-date estate plan that meets their needs and wishes.

Financial implications

Will hopping can have a number of financial implications, including increased costs associated with estate administration. Probate is the legal process of administering an estate, and it can be a complex and expensive process. When there are multiple wills, it can make probate even more complicated and costly.

- Executor fees: The executor of an estate is responsible for managing the probate process. Executors are typically paid a fee for their services, and the fee is based on the value of the estate. When there are multiple wills, it can increase the amount of time and effort required by the executor, which can lead to higher fees.

- Attorney fees: Attorneys are often involved in the probate process, and their fees can also be based on the value of the estate. When there are multiple wills, it can increase the amount of work required by the attorney, which can lead to higher fees.

- Court costs: In some cases, it may be necessary to go to court to resolve disputes over multiple wills. This can lead to additional court costs, which can further increase the cost of estate administration.

Overall, will hopping can have a number of negative financial implications. It is important for individuals to work with an estate planning attorney to create a comprehensive and up-to-date estate plan that meets their needs and wishes.

Personal implications

Will hopping can be a sign of indecisiveness or a lack of estate planning knowledge. Indecisiveness can lead to procrastination, which can result in an individual putting off the creation or update of their will. This can lead to a situation where the individual dies without a valid will, which can have a number of negative consequences for their estate and their beneficiaries.

A lack of estate planning knowledge can also lead to will hopping. Individuals who do not understand the importance of estate planning or who are not aware of the various estate planning options available to them may be more likely to make changes to their will without considering the potential consequences.

There are a number of practical implications of understanding the connection between will hopping and personal implications. First, it can help individuals to recognize the importance of creating and updating their will. Second, it can help individuals to understand the potential consequences of making changes to their will without considering the potential consequences.

Overall, understanding the connection between will hopping and personal implications can help individuals to make informed decisions about their estate planning.

Tax implications

Will hopping can be used to avoid or minimize estate taxes, although modern estate planning techniques are more effective for this purpose. Estate taxes are taxes on the transfer of property at death. Will hopping can be used to avoid or minimize estate taxes by transferring assets to beneficiaries before death. However, modern estate planning techniques, such as trusts and joint ownership, are more effective for avoiding or minimizing estate taxes.

There are a number of reasons why will hopping is not as effective as modern estate planning techniques for avoiding or minimizing estate taxes. First, will hopping can be difficult to implement and can be challenged by the IRS. Second, will hopping can have negative consequences, such as increasing the costs of estate administration and creating uncertainty and confusion among beneficiaries.

Overall, will hopping is not an effective way to avoid or minimize estate taxes. Modern estate planning techniques are more effective and can be tailored to meet the specific needs of individuals and their families.

Beneficiary implications

Will hopping can have a significant impact on beneficiaries, as it can be used to disinherit certain family members or make provisions for individuals who were not initially included in the will. There are a number of reasons why a will hopper may choose to do this. For example, they may have had a falling out with a family member, or they may have met someone new who they wish to provide for. Whatever the reason, will hopping can have a profound impact on the distribution of an estate.

- Disinheriting family members

Will hopping can be used to disinherit certain family members, either intentionally or unintentionally. For example, if a will hopper creates a new will that leaves all of their assets to a new partner, their children from a previous marriage may be disinherited. This can lead to conflict and litigation among family members. - Providing for individuals not initially included in the will

Will hopping can also be used to make provisions for individuals who were not initially included in the will. For example, a will hopper may create a new will that leaves a bequest to a friend or charity. This can be a way to provide for those who are not traditional beneficiaries, such as stepchildren or close friends.

Overall, will hopping can have a significant impact on beneficiaries. It is important to be aware of the potential consequences of will hopping, both positive and negative, before making any changes to your will.

Executor implications

Will hopping can have a number of implications for executors, as it can make it difficult to administer the estate according to the testator's wishes. There are a number of reasons why this may be the case.

- Multiple wills

One of the biggest challenges for executors is dealing with multiple wills. If a testator has created multiple wills, it can be difficult to determine which will is the most recent and valid. This can lead to confusion and uncertainty, and it can make it difficult for the executor to distribute the estate according to the testator's wishes. - Conflicting instructions

Another challenge for executors is dealing with conflicting instructions in multiple wills. For example, a testator may have made different bequests to the same beneficiary in different wills. This can create confusion and uncertainty, and it can make it difficult for the executor to determine how to distribute the estate. - Lack of clarity

Will hopping can also lead to a lack of clarity in the testator's wishes. For example, a testator may have made changes to their will without consulting with their attorney. This can lead to errors and omissions in the will, which can make it difficult for the executor to administer the estate according to the testator's wishes.

Overall, will hopping can make it difficult for executors to administer the estate according to the testator's wishes. It is important for testators to work with an estate planning attorney to create a comprehensive and up-to-date estate plan that meets their needs and wishes.

Contestation implications

Will hopping is the practice of making frequent changes to one's will, often without consulting with an attorney or other professional. This can lead to a number of problems, including the increased likelihood of a will being contested. Beneficiaries who feel that they have been unfairly treated in a will may challenge its validity, leading to costly and time-consuming litigation.

- Lack of clarity

One of the most common reasons for a will to be contested is a lack of clarity. Will hopping can lead to confusion about the testator's final wishes, as they may have made changes to their will without properly documenting their intentions. This can make it difficult for the court to determine how to distribute the estate, and can lead to disputes among the beneficiaries. - Undue influence

Another common reason for a will to be contested is undue influence. This occurs when someone takes advantage of a testator's vulnerability to pressure them into changing their will. Will hopping can increase the risk of undue influence, as it provides more opportunities for someone to exert pressure on the testator. - Lack of capacity

A will can also be contested if the testator lacked the capacity to make a valid will. This can occur if the testator was suffering from a mental illness or was under the influence of drugs or alcohol at the time they signed the will. Will hopping can increase the risk of a will being contested on the grounds of lack of capacity, as it can be difficult to determine the testator's mental state at the time they made each change to their will.

Overall, will hopping can increase the likelihood of a will being contested. This can lead to costly and time-consuming litigation, and can ultimately result in the testator's wishes not being carried out. It is important for individuals to work with an estate planning attorney to create a comprehensive and up-to-date estate plan that meets their needs and wishes.

Planning implications

Will hopping is the practice of making frequent changes to one's will, often without consulting with an estate planning attorney. This can lead to several problems, including the increased likelihood of a will being contested, disputes among beneficiaries, and confusion about the testator's final wishes.

Working with an estate planning attorney can help to avoid these problems by creating a comprehensive and up-to-date estate plan that meets the testator's needs and wishes. An estate planning attorney can also provide guidance on how to make changes to a will in a way that is legally valid and does not create confusion.

- Facet 1: Clarity

A comprehensive estate plan will clearly state the testator's wishes and intentions. This can help to avoid confusion and disputes among beneficiaries. An estate planning attorney can help to ensure that the will is drafted in a way that is easy to understand and interpret. - Facet 2: Validity

An estate planning attorney can help to ensure that the will is valid and legally enforceable. This includes ensuring that the will is properly executed and witnessed, and that the testator had the capacity to make a will at the time it was signed. - Facet 3: Flexibility

An estate plan should be flexible enough to accommodate changes in the testator's circumstances. An estate planning attorney can help to create a plan that can be easily modified if the testator's needs or wishes change. - Facet 4: Cost-effectiveness

Working with an estate planning attorney can actually save money in the long run by avoiding the costs of will contests and other disputes.

Overall, working with an estate planning attorney to create a comprehensive and up-to-date estate plan is the best way to avoid the problems associated with will hopping. This will help to ensure that the testator's wishes are carried out and that their estate is distributed according to their intentions.

Frequently Asked Questions on Will Hopping

Will hopping, the practice of making frequent changes to one's will, can raise several questions and concerns. This section addresses some common inquiries to clarify the implications of will hopping and guide individuals in making informed decisions.

Question 1: What are the potential drawbacks of will hopping?

Will hopping can lead to confusion and uncertainty about the testator's final wishes, increase the likelihood of will contests and disputes among beneficiaries, and incur additional costs associated with estate administration.

Question 2: Can will hopping be used to avoid estate taxes?

While will hopping may have been used historically to minimize estate taxes, modern estate planning techniques, such as trusts and joint ownership, are more effective and legally recognized for tax optimization.

Question 3: How does will hopping impact beneficiaries?

Will hopping can have significant implications for beneficiaries, including the potential for disinheritance or alterations in inheritance distribution. It is crucial for individuals to clearly communicate their intentions with beneficiaries to avoid confusion and disputes.

Question 4: What are the legal implications of will hopping?

Multiple wills or conflicting instructions in different versions of a will can lead to legal challenges and probate complications. Courts may need to determine the validity and precedence of each will, which can be time-consuming and costly.

Question 5: How can I avoid the pitfalls of will hopping?

To avoid the potential drawbacks of will hopping, it is advisable to work with an estate planning attorney to create a comprehensive and up-to-date estate plan that reflects your wishes clearly and minimizes the risk of contestation.

Question 6: What is the best approach to making changes to my will?

When considering changes to your will, consult with an estate planning attorney to ensure the modifications are legally valid, consistent with your intentions, and do not create undue confusion or complications during probate.

Summary: Will hopping, while not recommended, can be legally permissible. However, it is essential to understand the potential consequences and implications before engaging in this practice. Consulting an estate planning professional is highly advisable to ensure your wishes are clearly expressed and legally binding.

Transition: For further insights into will hopping, its implications, and effective estate planning strategies, explore the following sections.

Will Hopping

Will hopping, the practice of making frequent changes to one's will, can have significant implications for estate planning. To navigate this complex topic, consider the following tips:

Tip 1: Understand the Potential Pitfalls

Will hopping can lead to confusion, legal challenges, and increased costs during probate. Multiple wills or conflicting instructions can create uncertainty about the testator's final wishes.

Tip 2: Seek Legal Guidance

Consulting an estate planning attorney is crucial to ensure your will is legally valid, clearly expresses your intentions, and minimizes the risk of contestation.

Tip 3: Communicate with Beneficiaries

Openly communicating your estate plans with beneficiaries can help avoid misunderstandings and disputes. Discuss your intentions and the reasons behind any changes to your will.

Tip 4: Consider a Revocable Living Trust

A revocable living trust can provide greater flexibility and control over your assets during your lifetime and after your death, potentially reducing the need for frequent will changes.

Tip 5: Regularly Review and Update Your Will

Life circumstances and legal regulations can change over time. Periodically reviewing and updating your will ensures it remains aligned with your current wishes and legal requirements.

Summary: Will hopping can be a complex and potentially problematic practice. By understanding the pitfalls, seeking legal guidance, communicating with beneficiaries, considering alternative estate planning tools, and regularly reviewing your will, you can make informed decisions that safeguard your wishes and protect your loved ones.

Transition: For further insights into will hopping and effective estate planning strategies, explore the following sections.

Conclusion

Will hopping, the practice of making frequent changes to one's will, can have significant implications for estate planning. It can create confusion, legal challenges, and increased costs during probate. To navigate this complex topic, individuals should understand the potential pitfalls, seek legal guidance, communicate with beneficiaries, consider alternative estate planning tools, and regularly review and update their will.

By taking these steps, individuals can make informed decisions that safeguard their wishes and protect their loved ones. Estate planning is an ongoing process that requires careful consideration and professional guidance to ensure that one's legacy is distributed according to their intentions.

Unveiling The Secrets Of Joe Biden's Height: Surprising Discoveries And Insights

Uncover The Secrets Of Diario Juarez: A Treasure Trove Of Local Insights For The Curious

Unveiling The Power And Impact Of Symbols Of Defiance

Hopper Villains Wiki Fandom

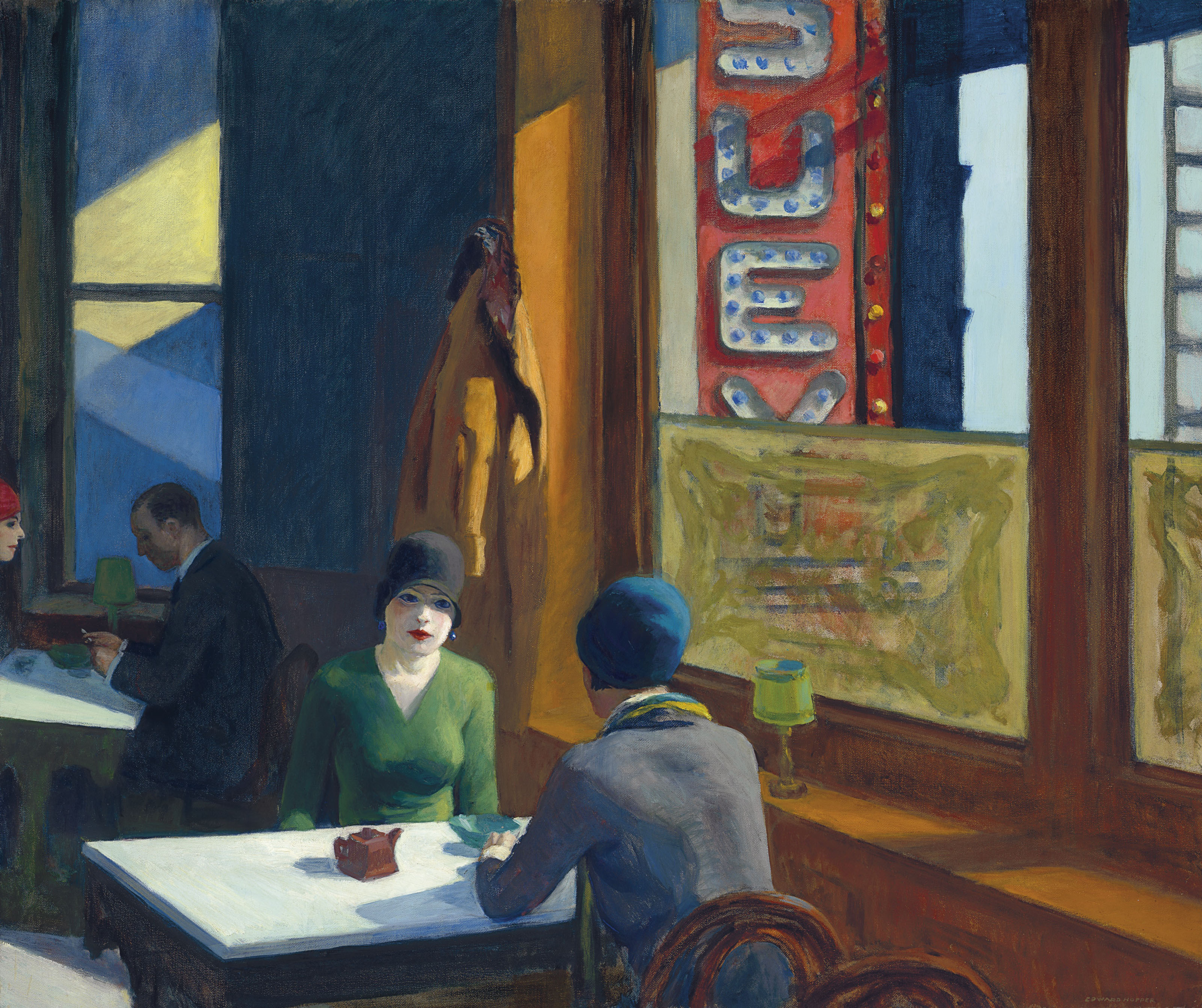

ArtDependence Chop Suey, 1929 — the Most Iconic Edward Hopper

Edward Hopper Artwork

ncG1vNJzZmibmKSwrLjArWWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvWoqOlZZikvbGx0WefraWc