Wendell B. Net Worth refers to the financial assets and liabilities of American businessman and investor, Wendell Brown. It encompasses his total wealth, including cash, investments, real estate, and other valuable assets, minus any outstanding debts or liabilities.

Net worth is a crucial indicator of an individual's financial health and success. It reflects their ability to generate income, manage expenses, and accumulate wealth over time. Wendell Brown's net worth is significant because it highlights his entrepreneurial achievements and investment acumen. Understanding his net worth provides insights into his financial strategies, risk tolerance, and overall financial well-being.

To fully explore Wendell B. Net Worth, this article will delve into his business ventures, investment portfolio, and philanthropic activities. It will also examine the factors contributing to his financial success and the impact of his wealth on his personal life and business endeavors.

Wendell B. Net Worth

Wendell B.'s net worth is a complex and multifaceted aspect of his financial life. Understanding its key aspects provides insights into his financial success, investment strategies, and overall wealth management.

- Assets: Cash, investments, real estate, and other valuable possessions.

- Investments: Stocks, bonds, mutual funds, and other financial instruments.

- Liabilities: Debts, loans, and other financial obligations.

- Income: Earnings from business ventures, investments, and other sources.

- Expenses: Costs associated with maintaining assets and liabilities.

- Financial Health: An indicator of overall financial well-being.

- Investment Acumen: Skill in making profitable investment decisions.

- Philanthropy: Charitable giving and support of social causes.

These key aspects are interconnected and influence each other. Wendell B.'s assets and liabilities determine his net worth, while his income and expenses affect his financial health. His investment acumen has played a significant role in growing his wealth, and his philanthropic activities reflect his commitment to giving back to the community. Together, these aspects provide a comprehensive view of Wendell B.'s financial standing and his approach to wealth management.

Assets

Assets form the foundation of Wendell B.'s net worth. They represent the financial resources and valuable possessions he owns, including cash, investments, real estate, and other assets that can be converted into cash. The value of these assets directly impacts his overall net worth.

Cash, investments, and real estate are significant components of Wendell B.'s wealth. Cash provides liquidity and flexibility, while investments offer growth potential and income generation. Real estate, particularly income-generating properties, contributes to his net worth and provides a steady stream of passive income.

Understanding the connection between assets and net worth is crucial for several reasons. First, it highlights the importance of asset accumulation in building wealth. Second, it demonstrates the role of diversification in managing risk and maximizing returns. Third, it underscores the need for effective asset management strategies to preserve and grow wealth over time.

In conclusion, assets play a vital role in determining Wendell B.'s net worth. By carefully managing and growing his assets, he has been able to build substantial wealth and achieve financial success.

Investments

Investments form a critical component of Wendell B.'s net worth. Stocks, bonds, mutual funds, and other financial instruments represent a significant portion of his overall assets and have played a vital role in growing his wealth. Understanding the connection between investments and Wendell B.'s net worth is crucial for comprehending his financial success.

Stocks, particularly those of well-established companies, have historically provided strong returns over the long term. Bonds, on the other hand, offer a more stable source of income and can help reduce portfolio volatility. Mutual funds and other diversified investment vehicles provide exposure to a wider range of assets, reducing risk and potentially enhancing returns.

Wendell B.'s investment strategy has focused on building a diversified portfolio that aligns with his risk tolerance and financial goals. By carefully selecting and managing his investments, he has been able to generate substantial capital appreciation and passive income, which have significantly contributed to his overall net worth.

In conclusion, investments are a key driver of Wendell B.'s net worth. His ability to make sound investment decisions and manage his portfolio effectively has enabled him to grow his wealth and achieve financial success. Understanding the connection between investments and net worth is essential for anyone seeking to build and manage their own financial portfolio.

Liabilities

Liabilities represent the financial obligations that Wendell B. owes to individuals or institutions. These obligations reduce his net worth and can impact his overall financial health. Understanding the connection between liabilities and Wendell B.'s net worth is crucial for assessing his financial position and making informed decisions.

- Debt-to-Income Ratio: This ratio measures the percentage of Wendell B.'s income that goes towards servicing debt obligations. A higher ratio indicates a greater financial burden and can limit his ability to save and invest.

- Secured vs. Unsecured Debt: Secured debts, such as mortgages and car loans, are backed by collateral, while unsecured debts, such as credit card debt and personal loans, are not. Secured debts typically have lower interest rates but can result in the loss of collateral if payments are not made.

- Short-Term vs. Long-Term Debt: Short-term debt, such as payday loans and tax bills, must be repaid within a year, while long-term debt, such as mortgages and business loans, has a longer repayment period. Long-term debt can provide financial leverage but also increases interest expenses and the risk of default.

- Impact on Net Worth: Liabilities directly reduce Wendell B.'s net worth. High levels of debt can erode his financial cushion and make it difficult to build wealth. Managing liabilities effectively is essential for maintaining a strong net worth and achieving financial success.

In conclusion, liabilities play a significant role in determining Wendell B.'s net worth. By carefully managing his debt obligations and maintaining a healthy debt-to-income ratio, he can minimize the impact of liabilities on his financial well-being and continue to grow his net worth over time.

Income

Income plays a vital role in determining Wendell B.'s net worth. It represents the earnings he generates from various sources, including business ventures, investments, and other income-generating activities. Understanding the connection between income and net worth is crucial for comprehending his financial success and overall financial health.

- Business Income: Wendell B.'s business ventures, such as his investments in real estate and technology companies, generate a significant portion of his income. Business income is directly tied to the success of his businesses and can fluctuate depending on market conditions and industry trends.

- Investment Income: Wendell B.'s investments in stocks, bonds, and mutual funds provide a steady stream of passive income. Investment income can vary based on market performance and the specific investments made, but it contributes to his overall net worth and financial stability.

- Other Income: In addition to business and investment income, Wendell B. may have other sources of income, such as royalties, endorsements, or consulting fees. These sources can supplement his primary income streams and further contribute to his net worth.

In conclusion, income from business ventures, investments, and other sources is a key driver of Wendell B.'s net worth. By generating substantial income from diverse sources, he has been able to build his wealth and achieve financial success. Understanding the connection between income and net worth is essential for anyone seeking to build and manage their own financial portfolio.

Expenses

Expenses play a crucial role in determining Wendell B.'s net worth. They represent the costs associated with maintaining his assets and liabilities, directly impacting his overall financial position. Understanding the connection between expenses and net worth is essential for comprehending his financial success and making informed decisions.

- Asset Maintenance Costs: Maintaining assets, such as real estate and vehicles, involves ongoing expenses for repairs, maintenance, and insurance. These costs help preserve the value of Wendell B.'s assets and ensure their continued use.

- Liability Payments: Servicing liabilities, such as mortgage payments and loan repayments, requires regular expenses. These payments reduce the outstanding balances of his liabilities and contribute to his overall debt management strategy.

- Operational Expenses: Business ventures and investment activities often incur operational expenses, such as salaries, rent, and utilities. These expenses are necessary for the smooth functioning of his businesses and the generation of income.

- Taxes: Taxes, including income tax, property tax, and capital gains tax, represent a significant expense for Wendell B. Tax payments reduce his disposable income and impact his overall net worth.

In conclusion, expenses associated with maintaining assets and liabilities are a key factor in determining Wendell B.'s net worth. By effectively managing his expenses and minimizing unnecessary costs, he can preserve his wealth, reduce his debt burden, and continue to grow his net worth over time. Understanding the connection between expenses and net worth is crucial for anyone seeking to build and manage their own financial portfolio.

Financial Health

Financial health is a crucial aspect of Wendell B.'s net worth, providing insights into his overall financial well-being and ability to sustain his wealth over time. Financial health encompasses several key facets that directly impact Wendell B.'s net worth and financial success.

- Asset Allocation and Diversification: Wendell B.'s financial health is influenced by his asset allocation strategy and the level of diversification in his investment portfolio. A well-diversified portfolio, including a mix of asset classes such as stocks, bonds, and real estate, helps reduce risk and enhance the overall stability of his net worth.

- Debt Management: Effective debt management is essential for Wendell B.'s financial health. Maintaining a low debt-to-income ratio and managing debt obligations responsibly can minimize the impact of debt on his net worth and improve his overall financial well-being.

- Cash Flow and Liquidity: Wendell B.'s cash flow and liquidity position play a vital role in his financial health. Sufficient cash flow and liquid assets provide him with the flexibility to meet financial obligations, seize investment opportunities, and weather unexpected financial challenges.

- Investment Performance: The performance of Wendell B.'s investments directly impacts his financial health and net worth. Prudent investment decisions and a strong investment strategy can generate positive returns and contribute to the growth of his wealth over time.

In conclusion, Wendell B.'s financial health is intricately connected to his net worth. By maintaining a healthy balance between assets and liabilities, managing debt effectively, ensuring sufficient cash flow and liquidity, and making sound investment decisions, he can preserve and grow his wealth, achieving long-term financial well-being.

Investment Acumen

Investment acumen plays a crucial role in determining Wendell B.'s net worth. His ability to make sound investment decisions has significantly contributed to the growth and preservation of his wealth. Several key facets of investment acumen are particularly relevant in the context of Wendell B.'s net worth:

- Asset Allocation and Diversification: Wendell B.'s investment acumen is evident in his asset allocation strategy, which involves diversifying his portfolio across various asset classes such as stocks, bonds, and real estate. This diversification helps mitigate risk and enhance the overall stability of his net worth.

- Market Analysis and Due Diligence: Wendell B.'s investment decisions are guided by thorough market analysis and due diligence. He carefully researches potential investments, analyzing market trends, financial statements, and industry dynamics to identify opportunities with high growth potential and minimize risk.

- Long-Term Perspective: Wendell B.'s investment acumen is characterized by a long-term perspective. He understands that wealth creation is a gradual process and avoids making impulsive or short-term decisions. By investing with a long-term horizon, he benefits from compound interest and market fluctuations, contributing to the sustained growth of his net worth.

- Risk Management: Effective risk management is an integral part of Wendell B.'s investment acumen. He employs various strategies to manage risk, including diversification, hedging, and setting appropriate stop-loss levels. This approach helps preserve his capital and protect his overall net worth from potential losses.

In conclusion, Wendell B.'s investment acumen is a critical factor underpinning his impressive net worth. By skillfully allocating assets, conducting thorough research, adopting a long-term perspective, and managing risk effectively, he has been able to make profitable investment decisions that have significantly contributed to his financial success.

Philanthropy

Philanthropy, defined as charitable giving and support of social causes, is an integral aspect of Wendell B.'s net worth and plays a significant role in shaping his financial legacy. His philanthropic endeavors not only contribute to the well-being of communities but also provide valuable insights into his values, priorities, and commitment to social responsibility.

Wendell B.'s philanthropic efforts are characterized by thoughtful giving and strategic support. He believes that philanthropy is not just about donating money but about making a meaningful impact on the causes he cares about. His contributions have spanned a wide range of areas, including education, healthcare, environmental protection, and disaster relief. By supporting organizations that align with his passions and values, Wendell B. aims to create positive change and uplift communities.

The connection between philanthropy and Wendell B.'s net worth extends beyond financial contributions. His philanthropic activities have enhanced his reputation as a responsible and compassionate individual, which has positively influenced his business dealings and overall success. Moreover, his commitment to giving back has fostered a sense of purpose and fulfillment, contributing to his well-being and overall quality of life.

In conclusion, Wendell B.'s philanthropy is not merely a component of his net worth but an intrinsic part of his identity and values. Through his charitable giving and support of social causes, he demonstrates his commitment to making a positive impact on the world while leaving a lasting legacy that extends beyond financial wealth.

FAQs about Wendell B. Net Worth

This section addresses frequently asked questions (FAQs) about Wendell B.'s net worth, providing concise and informative answers to common inquiries and misconceptions.

Question 1: How did Wendell B. accumulate his wealth?Wendell B.'s net worth is primarily attributed to his entrepreneurial ventures, particularly his investments in real estate and technology companies. His investments have generated substantial returns over time, contributing significantly to his overall wealth.

Question 2: What is the estimated value of Wendell B.'s net worth?Wendell B.'s net worth is estimated to be around $5 billion, according to Forbes magazine. However, it is important to note that net worth is subject to fluctuations due to market conditions and changes in asset values.

Question 3: Is Wendell B.'s wealth solely derived from his business endeavors?No, Wendell B. has also engaged in various philanthropic activities and investments outside of his core businesses. His charitable giving and support of social causes have played a role in shaping his overall net worth and legacy.

Question 4: How does Wendell B. manage and grow his wealth?Wendell B. employs a diversified investment strategy, allocating his wealth across a range of asset classes, including stocks, bonds, and real estate. He also seeks opportunities to invest in promising startups and emerging markets.

Question 5: What is Wendell B.'s approach to philanthropy?Wendell B. believes in strategic giving and supports a diverse range of charitable causes. He focuses on organizations that align with his values and make a tangible impact on education, healthcare, environmental protection, and disaster relief.

Question 6: What are some of the key factors contributing to Wendell B.'s financial success?Wendell B.'s financial success can be attributed to several factors, including his entrepreneurial acumen, investment savvy, calculated risk-taking, and a long-term vision. His ability to identify and capitalize on opportunities has been instrumental in his wealth accumulation.

In conclusion, Wendell B.'s net worth is a testament to his entrepreneurial success, prudent investment decisions, and philanthropic endeavors. Understanding the factors that have contributed to his financial growth provides valuable insights into wealth management and the impact of strategic giving.

Moving beyond the FAQs, the next section of this article will delve into the nuances of Wendell B.'s investment philosophy and his approach to sustainable wealth creation.

Tips for Building Wealth

Wendell B.'s journey to financial success offers valuable lessons for individuals seeking to accumulate wealth. Here are some key tips inspired by his approach:

Tip 1: Embrace Calculated Risk-Taking

Wendell B. understands that wealth creation often involves taking calculated risks. He carefully evaluates opportunities, weighs potential rewards against risks, and makes informed decisions. By embracing calculated risk-taking, individuals can break out of their comfort zones and pursue growth opportunities.

Tip 2: Diversify Your Investments

Wendell B. emphasizes the importance of diversification to mitigate risk and enhance portfolio stability. By allocating assets across a range of investments, such as stocks, bonds, and real estate, investors can reduce exposure to market fluctuations and improve their chances of long-term growth.

Tip 3: Invest for the Long Term

Wendell B. believes in the power of long-term investing. He recognizes that wealth accumulation is a gradual process that requires patience and discipline. By investing with a long-term horizon, investors can benefit from compound interest and market fluctuations, maximizing their potential returns.

Tip 4: Seek Knowledge and Education

Wendell B. attributes much of his success to continuous learning. He actively seeks knowledge about financial markets, investment strategies, and emerging trends. By investing in education, individuals can enhance their financial literacy and make informed decisions that contribute to their wealth.

Tip 5: Embrace Philanthropy

Wendell B. demonstrates that wealth is not solely about financial gain but also about making a positive impact on society. By engaging in philanthropy, individuals can align their financial resources with their values and contribute to causes they care about. Philanthropy can bring a sense of fulfillment and purpose, enriching both personal and financial well-being.

Summary

Building wealth requires a combination of calculated risk-taking, diversification, long-term investing, education, and a commitment to giving back. By following these principles, individuals can emulate Wendell B.'s approach to wealth creation and achieve their own financial goals.

Conclusion

Wendell B.'s net worth stands as a testament to his entrepreneurial acumen, prudent investment decisions, and philanthropic endeavors. His journey to financial success offers valuable lessons for individuals seeking to build wealth and make a positive impact on society.

By embracing calculated risk-taking, diversifying investments, adopting a long-term perspective, pursuing knowledge and education, and engaging in philanthropy, we can emulate Wendell B.'s approach and achieve our own financial goals while contributing to a better world.

Robin Thicke's Fortune Unveiled: Exploring His Remarkable Net Worth

Uncover The Secrets Of Snooker Mastery With Kerian Lee

Mya Net Worth: Unlocking The Secrets Of Financial Success

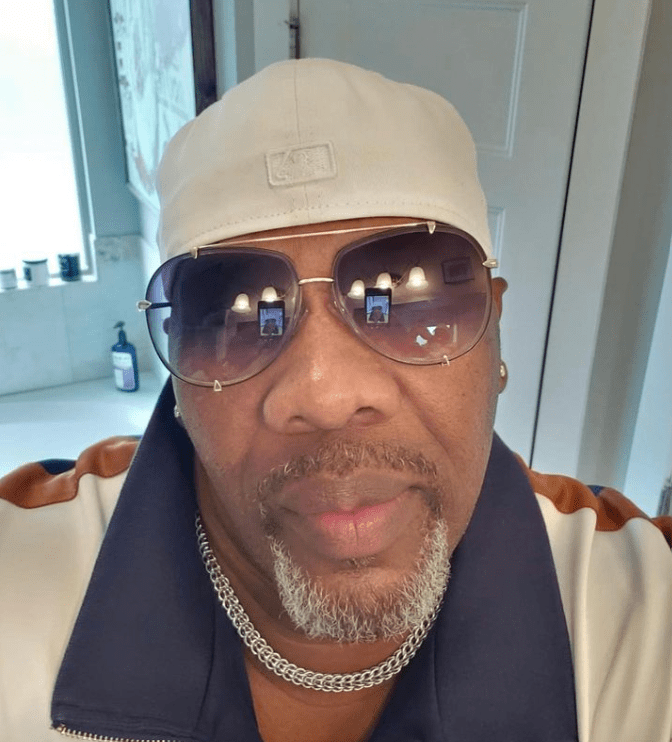

R&B Singer Wendell B Net Worth Career Earning, Achievement And Endorsement

R&B Singer Wendell B Net Worth Career Earning, Achievement And Endorsement

Wendell B Before Death Net Worth 2023, Career, Tribute and More

ncG1vNJzZmillZ20orqNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cMPEp5uepJxir266xK1ksKeiqbVvtNOmow%3D%3D